Thursday, 05 February 2026

MARKET ANALYSIS

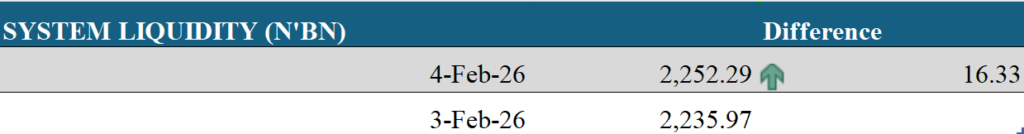

System Liquidity (Nigeria)

The banking system liquidity opened the day with surplus balance of ₦2.25 trillion, to extend the previous surplus level of ₦2.24 trillion. The slight improvement was solely driven by the increase in Deposit Money Banks (DMBs) placements at CBN’s Standing Deposit Facility (SDF) window to ₦2.10 trillion.

Projection: With an expected negative net flow from the ₦668.87 billion NTB maturity and settlement of ₦952.61 billion in NTB allotments, we expect funding rates to edge slightly higher.

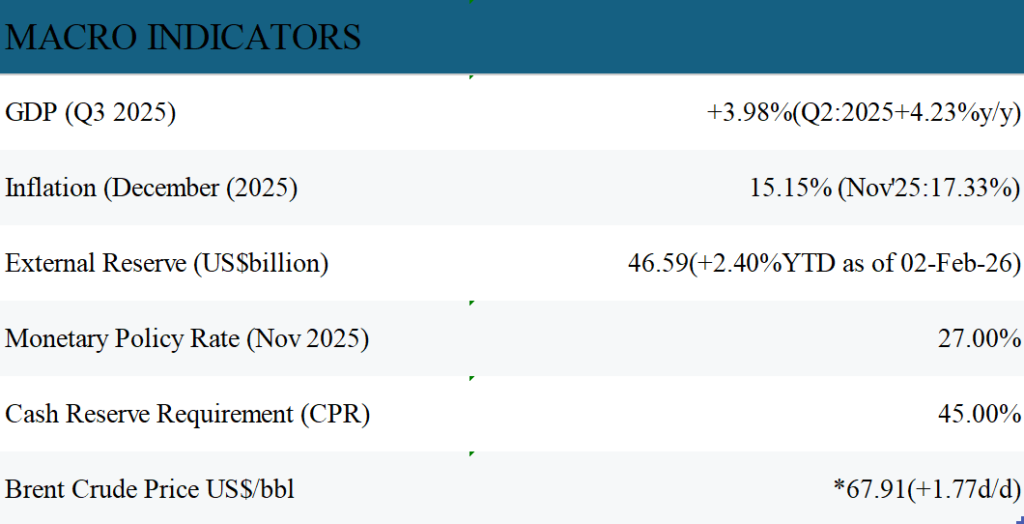

Source: CBN,INVESTING.COM

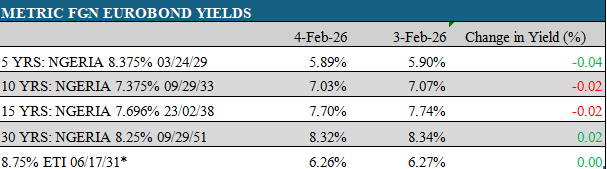

Eurobonds

The African Eurobonds market traded with mixed to positive bias, as sustained buying interest outweighed lingering global risk-off Sentiment, driving overall yield compression across the market. Buying interest was evident on some selected paper with, with notable yield decline on the short-dated papers like Nov-27 and Mar-29, which declined by 7bps and 4bps, respectively. Mid-tenor papers traded mixed as Jun-31 and Dec-34 saw yield compression by 5bps each, while Feb-32 and Sep-33 saw yield expansion by 2bps, each. At the long-end of the curve, yield dipped on Jan-46 and Sep-51by 1bp and 2bps, respectively.

Projection : Market to is expected to trade with the similar sentiment barring any adverse global macro developments.

Source: CBN,INVESTING.COM,AIICO Capital

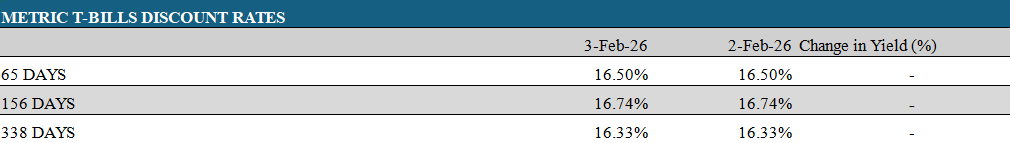

Treasury Bills

Trading activity remained muted across the mid-to-long segments, with most maturities closing flat. However, the 05-Mar-26 bill recorded a modest rate uptick of 19bps, marginally lifting overall market levels, while all other tenors closed unchanged amid balanced demandsupply dynamics.

Projection: We expect market participants to react to the outcome of the NTB auction and the prevailing market liquidity.

Source: FMDQ

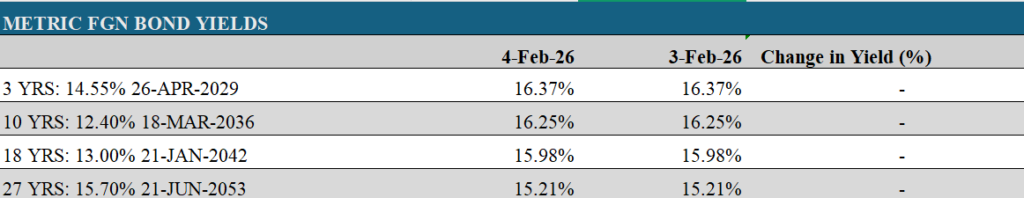

FGN Bonds

The FGN bond secondary market traded on a calm to mildly bullish note, as selective buying interest at the short-to-mid tenor of the curve, wile the long-dated papers traded flat. At the short end, yields were mixed, with the 17-Mar-27 bond recording a marginal 1bp expansion, while the 20-mar-28 bond saw yield compression of 1bp. Activity picked up significantly at the belly of the curve, where the 21-Feb-31, 27-Apr-32, 15-May33 bonds recorded notable yield compressions of 10bps, 12bps, and 14bps, respectively.

Projection : In the near term, we expect market activities to trade at similar level.

Source: FMDQ

Nigerian Equities

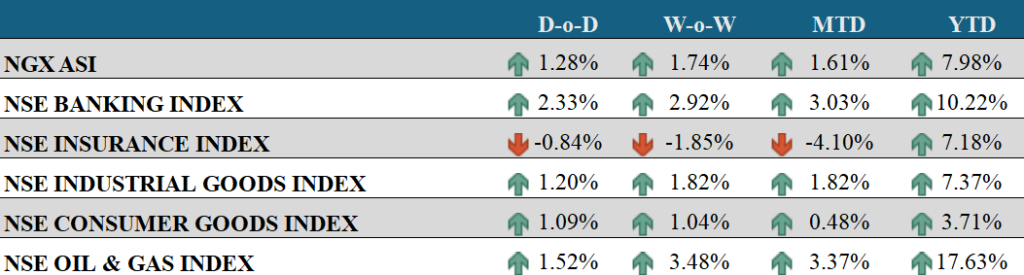

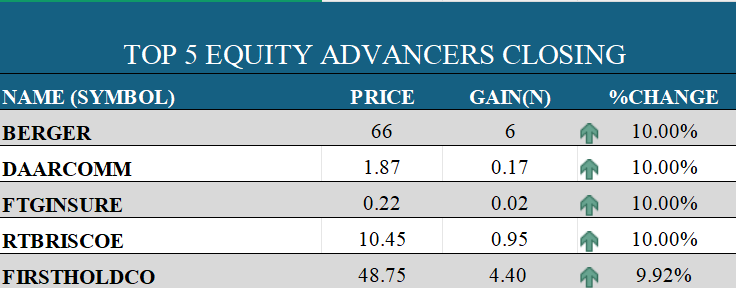

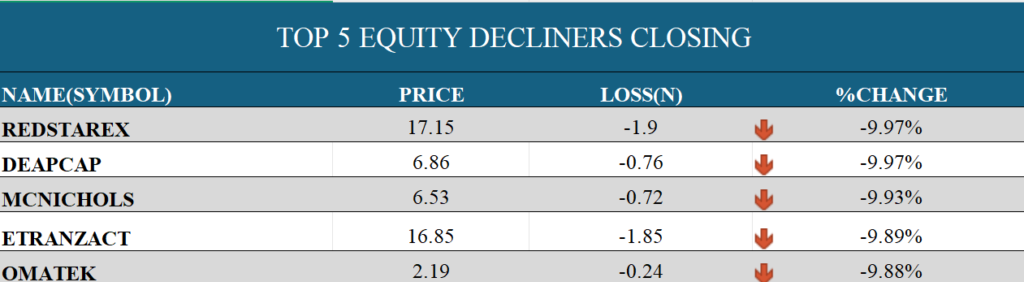

Amidst investors’ positive sentiment in notable high capped stocks, the Nigerian bourse closed the trading session on a high note as the All-Share Index (ASI) advanced by 1.28%, pushing YTD returns to 7.98%. FTGINSURE, DAARCOMM, RTBRISCOE, and BERGER topped the gainers’ chart with gains of 10.0% each, while DEAPCAP and REDSTAREX led the losers, shedding 9.97%, each. CHAMS recorded the highest trading volume with 57.4 million shares, while SEPLAT emerged as the most traded by value at ₦2.6 billion. Market breadth was positive, with 52 stocks advancing against 26 decliners.

Sectoral performance was broadly bullish as the Banking Index gained 2.3%, driven by ETI (+9.1%), UBA (+2.4%), FCMB (+1.8%), WEMABANK (+1.4%), FIDELITYBK (+1.4%), ZENITHBANK (+0.8%), GTCO (+0.3%), and ACCESSCORP (+0.2%), while STANBIC declined by 0.7%. The Consumer Goods Index rose by 1.1% on the back of gains in INTBREW (+8.2%), NASCON (+3.8%), and VITAFOAM (+0.4%), despite a 9.9% decline in MCNICHOLS. The Oil and Gas Index added 1.5%, supported by ARADEL (+3.7%) and JAPAULGOLD (+2.6%), although OANDO (0.4%) and ETERNA (-2.0%) closed lower. The Industrial Index advanced by 1.2%, driven by BERGER (+10.0%), AUSTINLAZ (+9.8%), CUTIX (+9.5%), WAPCO (+5.1%), CAP (+3.1%), and DANGCEM (+0.9%).Market turnover declined by 14.31% to ₦20.57 billion, with SEPLAT, ARADEL, FIRSTHOLDCO, WAPCO, and ZENITHBANK accounting for over 40% of total traded value.

Projection : We expect positive sentiment tomorrow, amid renewed bargain hunting in dividend paying stocks.

Source: NGX

Foreign Exchange

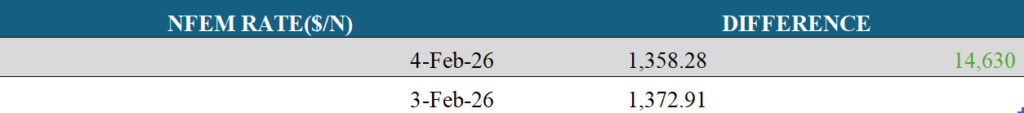

The Naira at the Nigerian Foreign Exchange Market (NFEM) traded on a positive note, to strengthened by 1.07% (₦14.63) against the U.S Dollar. The appreciation was driven by sustained inflows from Foreign Portfolio Investors (FPIs) and local participants as the Naira traded within the ₦1,348.00/$ and ₦1,365.00/$ band during the session before settling at ₦1,358.28/$. Meanwhile, external reserves was noted at $46.70 billion as of 3-Feb-2026, reflecting an addition of $105.84 million day-on-day.

Projection : Supported by current supply level conditions, we expect the exchange rate to trade around the similar band in the next session.

Source: CBN,INVESTING.COM

Commodities

Global oil prices climbed about 3%, on a report that the U.S. would not agree to change the location and format of talks with Iran planned for Friday. Brent crude spiked 3.33% or $2.24, hovering around $69.57 per barrel, while U.S. West Texas Intermediate (WTI) rose 3.39%, to around $65.35.

Similarly, gold prices dipped below $5,000 an ounce amid a lack of fresh catalysts to support the market following a historic price plunge late last week. Spot gold price dipped 49bps to $4,914.95/oz, while U.S. gold futures shed 17bps, hovering around $4,926.65/oz.

Projection : Precious metals are likely to remain supported on safe-haven demand after gold regained ground, while oil prices could stay elevated on lingering Middle East tension fears.

Source: INVESTING.COM,NBS,CBN, Bloomberg