Tuesday, 17 February 2026

MARKET ANALYSIS

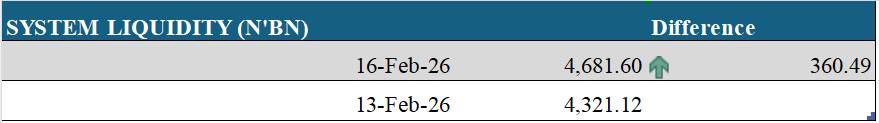

System Liquidity (Nigeria)

System liquidity commenced the week on a strong note, posting a surplus balance of ₦4.68 trillion, reflecting an increase of ₦360.49 billion compared to the previous session’s surplus position. The improvement was primarily driven by higher placements by Deposit Money Banks (DMBs) at the Central Bank of Nigeria’s (CBN) Standing Deposit Facility (SDF), which rose to ₦4.61 trillion. This was partially offset by ₦2.45 billion in Primary Market sales and ₦250 million accessed at the Standing Lending Facility (SLF) window.

In the same vein, the CBN conducted an Open Market Operations (OMO) auction, offering ₦600 billion, but ultimately allotted ₦1.35 trillion out of a total subscription of ₦2.04 trillion across the 8-day and 99-day tenors.

Consequently, average funding costs closed unchanged at 22.65%, with the Open Repo Rate (OPR) remaining steady at 22.50%, while the Overnight Rate (OVN) edged up marginally by 1 basis point (bp) to 22.79%.

Projection: In the absence of additional liquidity-tightening activities, funding costs are expected to ease marginally, supported by a projected net inflow of ₦520 billion from OMO maturities and settlements.

Source: CBN

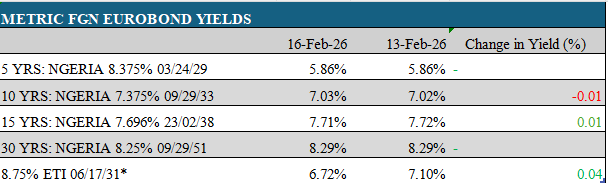

Eurobonds

The African Eurobond market began the week on a relatively calm, albeit mildly positive, footing as investors responded to softer-than-expected U.S. January CPI data of 2.4% (vs. 2.7% forecast), reinforcing expectations of a potentially earlier rate cut by the Federal Reserve.

Along Nigeria’s Eurobond curve, selective buying interest was observed across specific maturities. The Jan-49 bond recorded a 2 basis point (bp) decline in yield to 8.24%, while the Feb-30, Dec-34, Feb-38, and Nov-27 maturities each compressed by 1bp. In contrast, mild selling pressure emerged in the Jun-31, Feb-32, and Sept-33 maturities, which each edged higher by 1bp.

Overall, mixed activity across the curve resulted in the average Nigerian Eurobond yield remaining broadly unchanged at 7.02%.

Projection: In the next session, the market is anticipated to maintain a positive bias as investors digest recent domestic and global market updates.

Source: CBN,INVESTING.COM,AIICO Capital

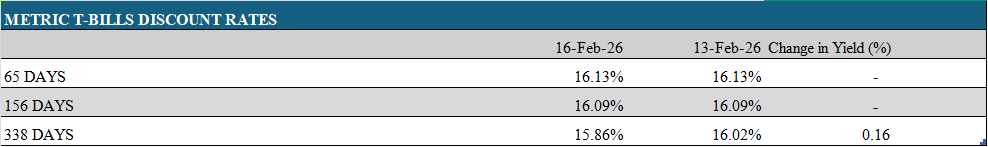

Treasury Bills

The NTB secondary market traded on a calm and largely neutral footing today, as muted activity across most maturities left rates broadly unchanged along the curve amid balanced demand and supply dynamics. Trading volumes remained subdued across the short- to mid-tenors, with the majority of instruments closing flat.

However, mild buying interest emerged at the longer end of the curve, where the February 2027 maturity recorded a 16 basis point (bp) decline in yield to close at 15.86%, reflecting selective investor demand. As a result, the average benchmark rate moderated slightly by 1bp to settle at 16.10%.

Projection: We anticipate a cautious market tone in the near term, as liquidity dynamics and investor positioning continue to shape trading activity.

Source: FMDQ

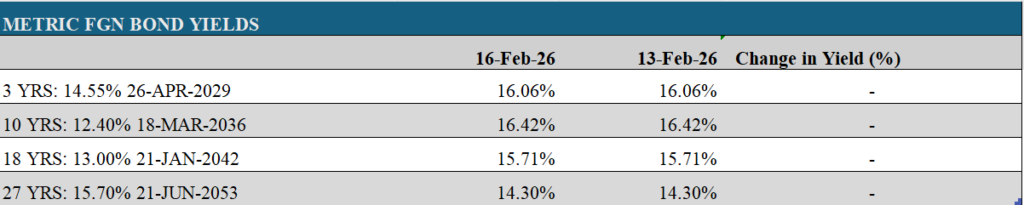

FGN Bonds

The FGN bond secondary market traded on a subdued and broadly mixed note, as slight yield adjustments across selected maturities influenced activity along the curve.

At the short end, yields were largely steady, with marginal increases recorded on the 17-Mar-27 and 23-Feb-28 bonds. In contrast, mild demand-led tightening was observed on the 20-Mar-27 and 20-Mar-28 issues.

The belly of the curve reflected a softer tone, as the 21-Feb-31 and 27-Apr-32 bonds posted yield increases, indicating pockets of selling interest. Trading activity elsewhere remained restrained, with investors maintaining a cautious approach.

At the long end, performance was mixed, as yield compression on the 21-Feb-34 bond offset a slight uptick on the 18-Jul-34, while most other long-dated securities closed unchanged.

In aggregate, the average benchmark yield advanced modestly by 2 basis points to close at 16.01%.

Projection: Over the near term, market sentiment is likely to remain guarded.

Source: FMDQ

Nigerian Equities

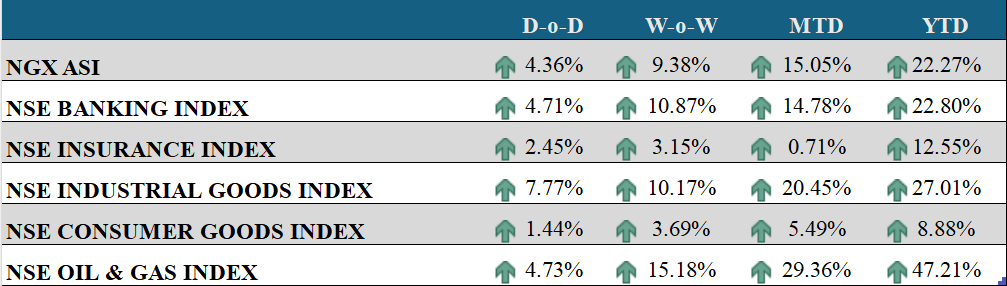

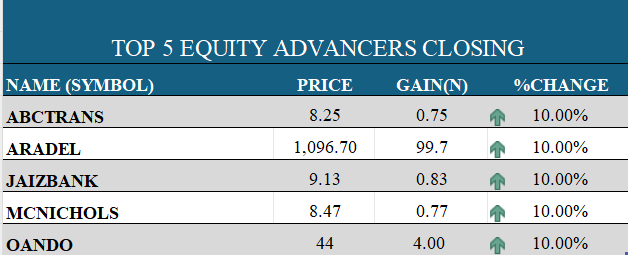

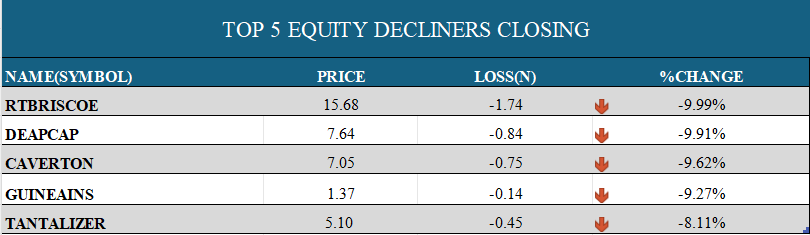

The Nigerian equities market closed positively as the All-Share Index (ASI) gained 436 basis points (bps), bringing year-to-date returns to 22.27%. Market breadth was strong, with 56 advancing stocks versus 27 decliners. Leading the gainers were ZICHIS, ABCTRANS, IKEJAHOTEL, MCNICHOLS, BETAGLAS, OANDO, and ARADEL, each up 10%, while RTBRISCOE topped the losers’ chart, declining 9.99%.

ACCESSCORP led activity by volume with 86.72 million shares traded, whereas ARADEL dominated by value at ₦11.02 billion.

Sector performance was broadly positive:

- The Banking Index rose 471bps, propelled by rallies in ZENITHBANK (+9.95%), ACCESSCORP (+8.87%), GTCO (+7.14%), WEMABANK (+5.58%), FCMB (+3.11%), UBA (+2.59%), and FIDELITYBK (+1.91%), despite a 2.22% decline in ETI.

- The Consumer Goods Index advanced 144bps, supported by gains in MCNICHOLS (+10%), NASCON (+9.06%), NESTLE (+6.31%), VITAFOAM (+5.18%), NB (+3.21%), CADBURY (+3.03%), DANGSUGAR (+2.07%), GUINNESS (+1.59%), and HONYFLOUR (+1.14%), partially offset by a 2.62% decline in PZ.

- The Oil & Gas Index climbed 473bps, buoyed by ARADEL (+10%), OANDO (+10%), and JAPAULGOLD (+9.96%).

- The NGX Industrial Index surged 777bps, driven by BETAGLAS (+10%), DANGCEM (+9.95%), BUACEMENT (+5.73%), WAPCO (+5.04%), and CUTIX (+2.42%).

Overall trade value rose 21.42% to $47.14 million, with MTNN, DANGCEM, BUACEMENT, and ZENITHBANK among the primary contributors to the bullish session.

Projection: Near-term market sentiment is expected to remain upbeat, driven by confidence in leading bellwether equities.

Source: NGX

Commodities

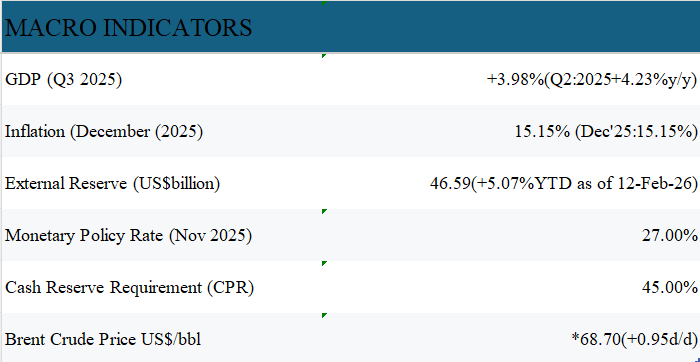

Global oil prices rose on Monday as investors assessed the potential market impact of upcoming U.S.-Iran talks aimed at easing tensions, amid expectations of higher OPEC+ supply. Brent crude gained 140bps (95 cents), trading around $68.70 per barrel, while U.S. West Texas Intermediate (WTI) increased 146bps to approximately $63.81 per barrel.

In contrast, gold prices declined slightly, reflecting improving risk sentiment and reduced safe-haven demand. Spot gold fell 49bps to $4,995.68/oz, while U.S. gold futures eased 45bps, hovering near $5,016.31/oz.

Projection: The oil market is expected to maintain a cautiously optimistic stance ahead of the U.S.-Iran negotiations, while gold is likely to sustain its bearish momentum unless geopolitical risks intensify.

Source: INVESTING.COM,NBS,CBN, Bloomberg

Foreign Exchange

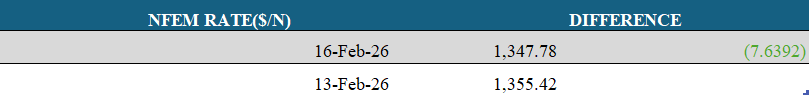

The Naira started the week on a firmer note at the Nigerian Foreign Exchange Market (NFEM), appreciating 56bps (₦7.64) to close at ₦1,347.78/US$. The currency’s gain was supported by improved FX supply following last week’s elevated demand pressures. Intraday trading saw the Naira fluctuate between ₦1,342.50/US$ and ₦1,353.00/US$.

Meanwhile, external reserves strengthened, rising by $135.76 million day-on-day to $47.81 billion as of 12 February 2026.

Projection : Supported by recent market trends, improved FX supply, and ongoing policy reform measures, the Naira is expected to maintain relative strength in the next trading session.

Source: CBN,INVESTING.COM