MARKET ANALYSIS

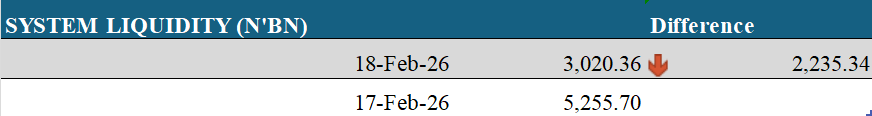

System Liquidity (Nigeria)

System liquidity commenced the week with a surplus of ₦3.02 trillion, reflecting a significant decline of ₦2.24 trillion compared to the previous session’s surplus position. The contraction was largely attributed to substantial placements by Deposit Money Banks (DMBs) at the Central Bank of Nigeria’s (CBN) Standing Deposit Facility (SDF), which totalled ₦2.96 trillion.

Despite the surplus position, average funding costs remained elevated at 22.67%. The Open Repo Rate (OPR) held steady at 22.50%, while the Overnight Rate (OVN) inched higher by 3 basis points (bps) to 22.83%.

Projection: Following today’s NTB auction, system liquidity is expected to moderate further in the next session, with funding rates likely to trend higher amid anticipated liquidity tightening.

Source: CBN

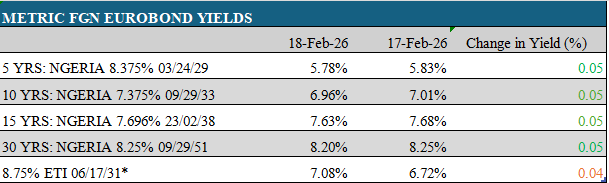

Eurobonds

The African Eurobond market traded on a strong footing, as persistent buying interest drove broad-based yield compression across most sovereign curves. Investor sentiment remained resilient, supported by improved risk appetite and selective positioning along the curve.

Across Nigeria’s Eurobond curve, yields declined across all maturities, reflecting sustained demand. At the short end, the Nov-2027 and Sep-2028 maturities compressed by 7bps and 8bps to 5.16% and 5.45%, respectively. In the mid-tenor segment, Mar-2029 and Feb-2030 declined by 5bps and 6bps to 5.78% and 6.10%. Meanwhile, long-dated instruments such as Jan-2046 and Sep-2051 fell by 7bps and 5bps to 8.14% and 8.20%, respectively.

Overall, the average Nigerian Eurobond benchmark yield eased by 5bps to settle at 6.93%.

Projection: In the next session, the market is expected to maintain a positive bias as participants react to both domestic and global market developments.

Source: INVESTING.COM,AIICO Capital

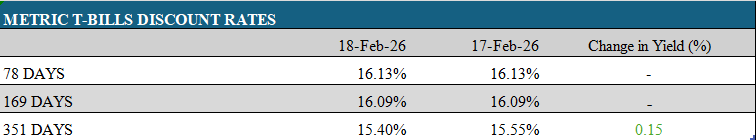

Treasury Bills

The NTB secondary market traded on a subdued note today, as investor attention shifted toward the NTB auction conducted during the session. Activity across the curve remained muted, with rates largely stable across most maturities amid balanced demand and supply conditions.

Selective demand was evident at the longer end, where the 04-Feb-27 bill declined by 15bps to settle at 15.40%. Meanwhile, short- to mid-tenors closed flat as market participants adopted a cautious approach.

As a result, the average benchmark rate edged lower by 1bp to close at 16.06%.

Projection: We expect market sentiment to remain measured in the near term, with liquidity dynamics and investor positioning likely to determine the direction of yields along the curve.

Source: FMDQ

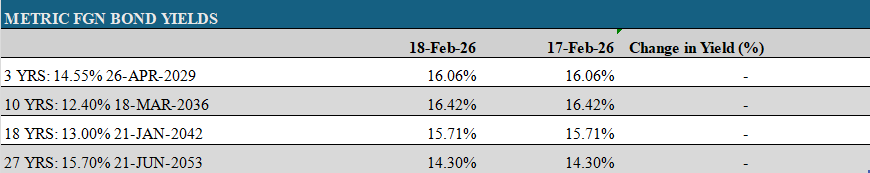

FGN Bonds

The FGN bond secondary market traded on a mildly positive note, as selective demand across mid-tenor maturities led to moderate yield compression, despite generally subdued activity along the curve.

At the short end, yields remained broadly stable, with marginal 1bp declines recorded on the 20-Mar-27 and 20-Mar-28 issues, while other nearby maturities closed unchanged. Activity across the belly of the curve was more pronounced, as strong buying interest in the 15-May-33, 21-Feb-34, and 18-Jul-34 bonds drove yield declines of 30bps, 29bps, and 40bps, respectively, to settle at 16.13%, 16.37%, and 16.27%.

Meanwhile, most long-dated maturities held firm amid cautious investor participation. Consequently, the average benchmark yield moderated by 5bps to close at 15.96%.

Projection: Over the near term, the market is expected to maintain a cautious bias as participants continue to monitor liquidity conditions and broader market developments.

Source: FMDQ

Nigerian Equities

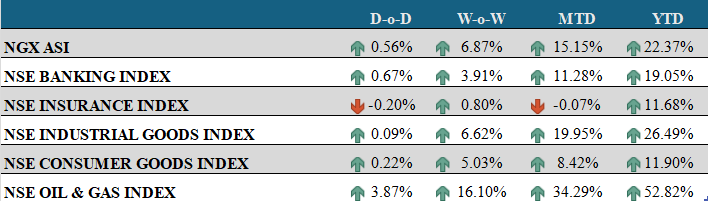

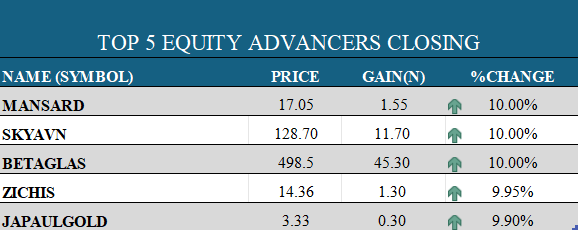

The Nigerian equities market closed in positive territory as the All-Share Index (ASI) advanced by 56bps, bringing year-to-date returns to 22.37%. Despite the index gain, market breadth was negative, with 33 gainers against 42 decliners.

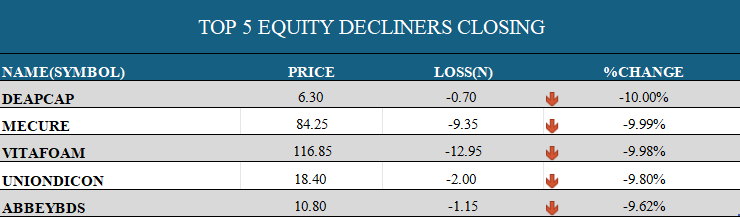

MANSARD, SKYAVN, and BETAGLAS topped the gainers’ chart with 10% gains each, while DEAPCAP recorded the steepest loss of the session at -10%. FCMB dominated market activity, leading both the volume and value charts with 2.94 billion shares traded and ₦35.88 billion in value, largely driven by a sizeable cross transaction.

Sectoral performance was broadly positive:

- The Banking Index rose 67bps, supported by gains in ETI (+4.65%), ZENITHBANK (+3.91%), FCMB (+3.80%), and UBA (+1.51%), which outweighed declines in WEMABANK (-0.92%), GTCO (-1.07%), FIDELITYBK (-1.68%), and ACCESSCORP (-2.91%).

- The Consumer Goods Index gained 22bps, driven by advances in MCNICHOLS (+9.52%), INTBREW (+2.78%), CADBURY (+2.17%), and UNILEVER (+1.58%), though losses in HONYFLOUR (-1.07%), PZ (-2.16%), CHAMPION (-4.37%), and VITAFOAM (-9.98%) moderated overall performance.

- The Oil and Gas Index outperformed, climbing 387bps, buoyed by strong buying interest in JAPAULGOLD (+9.90%) and SEPLAT (+8.33%), despite mild weakness in OANDO (-1.36%).

- The Industrial Index edged up 9bps, supported by gains in BETAGLAS (+10%), while CUTIX (-2.20%), AUSTINLAZ (-2.20%), and CAP (-8.21%) recorded declines.

Overall trade value increased by 3.03% to $46.11 million, with SEPLAT’s price appreciation contributing significantly to the ASI’s upward movement.

Projection: We anticipate mixed market sentiment in the near term as investors balance profit-taking with selective positioning in fundamentally strong stocks.

Source: NGX

Commodities

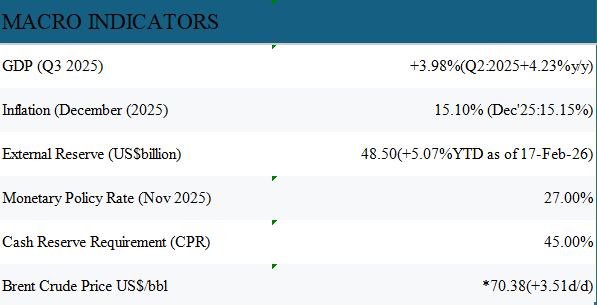

Global oil prices surged by over 4% on Wednesday as traders factored in potential supply disruptions amid escalating concerns of tensions between the United States and Iran, alongside stalled negotiations between Ukraine and Russia in Geneva. Brent crude jumped 5.25% ($3.51) to trade around $70.38 per barrel, while U.S. West Texas Intermediate (WTI) advanced 4.77% to approximately $65.23 per barrel.

In the precious metals market, gold prices rebounded, reversing the week’s earlier softening trend as safe-haven demand strengthened. Spot gold gained 211bps to $4,980.43/oz, while U.S. gold futures rose 193bps, hovering near $5,000.54/oz.

Projection: We expect the oil market to trade cautiously in the near term, particularly in light of evolving developments surrounding U.S.–Iran relations. Meanwhile, gold is likely to exhibit mixed sentiment as investors weigh geopolitical risks against broader macroeconomic conditions.

Source: INVESTING.COM,NBS,CBN, Bloomberg

Foreign Exchange

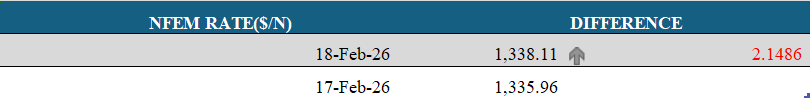

The Naira traded weaker at the Nigerian Foreign Exchange Market (NFEM), depreciating by 16bps (₦2.15) against the U.S. Dollar. The decline was primarily driven by elevated USD demand pressures, despite inflows from Foreign Portfolio Investors (FPIs) and domestic market participants.

During the session, the currency fluctuated within a range of ₦1,328.00/$ to ₦1,340.00/$ before settling at ₦1,338.11/$. Meanwhile, external reserves stood at $48.50 billion as of 17 February 2026, reflecting a day-on-day increase of $134.83 million.

Projection : We anticipate the Naira could trade at relatively firmer levels in the next session, supported by sustained FX inflows and improving market liquidity conditions.

Source: CBN,INVESTING.COM